What is Battery Energy Storage Revenue Stacking?

Stationary batteries can make or save money in a variety of ways.

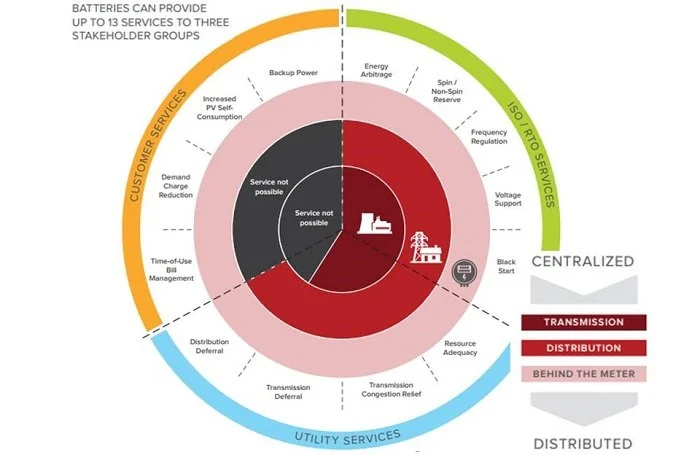

They can be used to directly reduce your utility bill by performing demand charge management (also called peak shaving) and to energy arbitrage. Or they can generate revenue in the form of cash payments for providing demand response, frequency regulation, or other ancillary services to the grid. Depending on the location, batteries may also enable utilities to defer the upgrades of their substations and other distribution equipment, which can have significant value which they may partially pass on to you. And of course, the most traditional use of a battery is to provide backup power during times that the grid goes down, which can have real value, even if no money is transacted.

The challenge is that often no single one of these use cases generates enough value to justify the capital cost of the battery right now. That’s the bad news.

But the good news is that most of these applications only require the battery to be used for a limited number of hours each day, month, and in some cases, each year. Think about that – you just commissioned a million-dollar asset and now it’s only going to be used for maybe 200 hours per year.

Energy storage revenue stacking

What if we could squeeze out a higher utilization from these batteries? Maybe you could get paid for providing frequency regulation to the grid in the morning and then use the battery for behind-the-meter peak shaving in the late afternoon while also getting the resiliency benefits? This is called revenue stacking and there is tremendous interest in it right now. It’s complicated for sure, but with the right software, it can be done.

Batteries can derive revenue from multiple stacked revenue streams (credit: RMI via Utility Drive)

In some ways, battery revenue stacking is really another form of the sharing economy. Maybe you have a big enough house so that when your parents come to visit, they have their own room and living space. But, they only visit twice a year, spending a week each time. That means that space is sitting vacant 96% of the time.

A few years ago, that’s just the way it was.

With the advent of Airbnb, however, it’s now really easy to monetize those extra rooms. Your in-laws can stay in them 4% of the year and you can bid the space into the market the rest of the time. In other words, you are revenue stacking by serving different applications.

What does this require?

Good planning, optimization, and analytics.

Maybe you ask your father-in-law when he’s planning to come and then block out those dates on your calendar. Then maybe you think about wear and tear on the space, and set some rules – we’d call them constraints – that tell airbnb you only want to rent the space for at least three nights at a time to minimize turnover. Maybe you even hire a cleaning crew and an on-site manager so that this operation is completely turnkey.

You probably see where we’re going with this.

Revenue stacking of batteries is much like renting out your extra space, your tools, or your car. The market now exists, you just need to decide if you should participate in it. And if so, what do you need to do? And how much money can you make?

We can help.

When it comes to batteries, you need to decide which applications your battery should serve, and when it should serve them. You also need to decide how big of a battery to invest in. You’ll want to know when the battery is going to be used, how long it will last, and a host of other metrics so that you can make the best financial decision.

We’ve developed our Redcloud energy optimization platform from the ground up using state-of-the-art mathematical optimization techniques to help you answer these questions and maximize the return on your energy assets.